Read this article in Français Deutsch Italiano Português Español

Market stabilization for ‘Telehandler30’ North American ranking

16 May 2024

While it’s not the double-digit growth of 2023, this year’s Telehandler30 still shows a market experiencing strong demand. ALH reports.

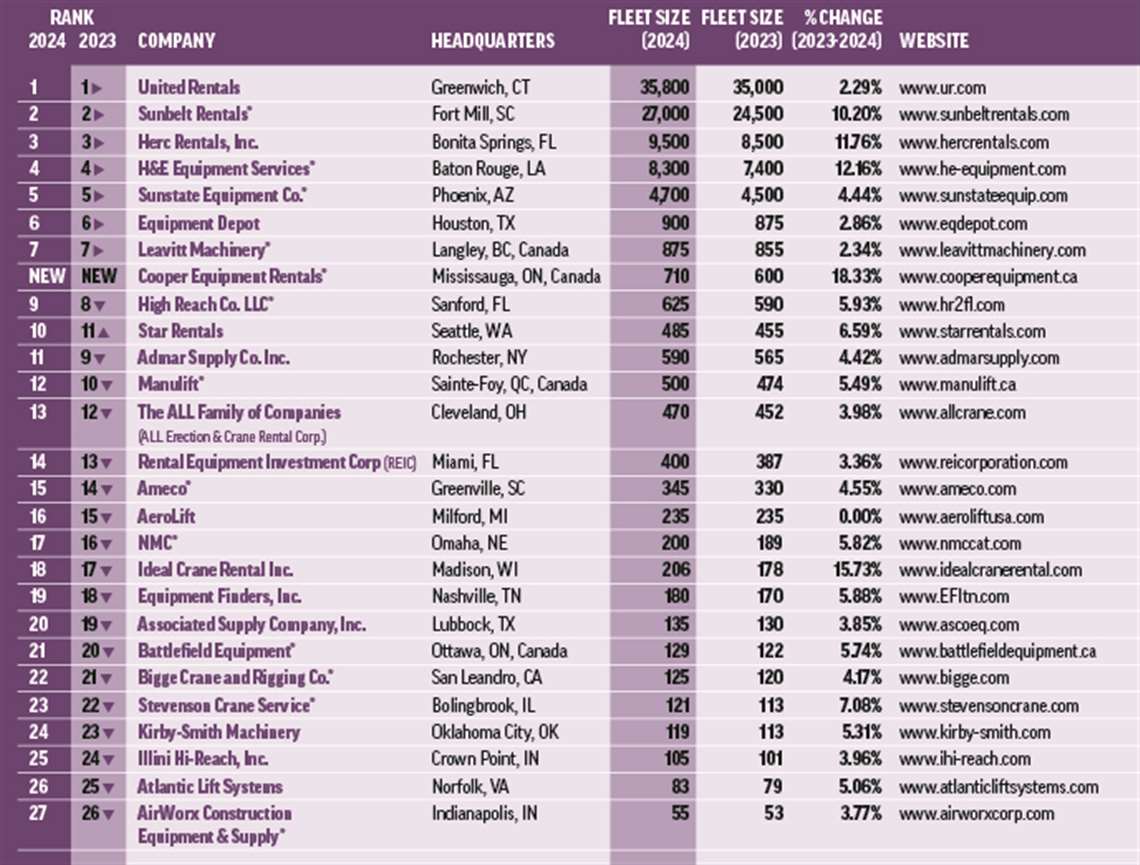

This year’s T30 ranking of North American telehandler rental fleets showcases steady growth for the industry, with every company listed – save one – adding units to their fleets.

Our annual ranking now tops out at a record-breaking 92,893 total units, up 6.67% compared to last year’s total of 87,086. Looking at our top five, we see 6.75% growth in fleet sizes, with our top 10 pulling in the most growth at 6.77%.

This demand for one of construction’s most versatile pieces of machinery falls in line with current market drivers: infrastructure, mega projects, onshoring and aging fleet replacement.

According to a recent study published by Off-Highway Research (OHR), 2023 was a banner year for construction equipment sales in the U.S., with telehandler sales coming out on top.

“In the US, growth was robust and most of the individual product categories saw increased sales,” says OHR Global Managing Director Chris Sleight. “But the standout in terms of both growth and volume was the telehandler.”

Total construction machinery sales for the year topped 305,000 units, up 8% year-over-year, marking the third consecutive record year for construction equipment sales – and the first time ever that more than 300,000 construction machines were sold in the US. According to OHR, telehandler sales rose by more than a third, with 30,000 units coming to market, representing nearly 10% of total machine sales, which aligns with recent OEM quarterly results.

For its Q1, JLG reported telehandler sales of US$373.4 million, a 9.37% increase year-over-year. JLG’s total access equipment sales for the quarter amounted to US$1.24 billion, with aerials seeing US$591 million in sales, and the company’s “other” category pulling in US$273.1 million. When we remove “other” from JLG’s two core access categories, telehandler sales amounted to 38.7% of JLG’s sales.

“Demand for aerial work platforms and telehandlers in North America continues to be solid, supported by infrastructure investments, mega projects and industrial onshoring projects as well as elevated fleet ages,” said John C. Pfeifer, Oshkosh president, CEO and director. “We’re really pleased with the market in access. We see continued demand drivers going forward. We talked about the Q4 order book was really strong. The $940 million that we just booked was better than our expectations. So we’re booked well through 2024 right now.”

Speaking directly to the telehandler market, John Boehme, JLG’s senior product manager – telehandlers, said, “The overall market demand for smaller, versatile equipment like compact telehandlers is very robust right now with all the infrastructure projects starting up this spring and summer. This means that the largest user of telehandlers continues to be general construction contractors.”

For Manitou, the same sentiments are echoed. “We see excellent demand with these machines in homebuilding and related industries, such as concrete contractors,” says Steve Kiskunas,

United Rentals saw growth and demand across both construction, led by non-res, and industrial end markets.

United Rentals saw growth and demand across both construction, led by non-res, and industrial end markets.

product manager — telescopic handlers, Manitou. “Overall demand is increasing — more telehandlers are being sold into the North American region across a number of markets. Part of the increased demand is because these units make telehandlers much more accessible – contractors who previously thought they could not afford a telescopic telehandler now realize it can be more practical and affordable than ever before.”

Looking to rental, United’s Matt Flannery said the world’s largest construction equipment rental firm saw growth – and demand - across both construction, led by non-res, and industrial end markets, with particular strength in manufacturing, utilities and downstream.

“We are continuing to see solid demand across a variety of end markets, customer segments, and geographies in 2024,” Flannery told investors recently. “This diversification provides for growth and resiliency.”

United, however, which ranks number one on this year’s T30, grew its telehandler fleet minimally over the last 12 months, increasing its total number of units by 2.29% to 35,800.

Sunbelt, Herc Rentals and H&E Equipment Services, on the other hand, all saw double-digit growth in their telehandler fleets, with H&E expanding by more than 12% to a total of 8,300 units.

Jim Koontz, founder of Michigan-based AeroLift, says the telehandler’s adaptability and flexibility are what keep these machines in demand.

Jim Koontz, founder of Michigan-based AeroLift, says the telehandler’s adaptability and flexibility are what keep these machines in demand.

On the independent side, Michigan-based AeroLift – the aforementioned company that held its fleet at the same level as ’23 – founder Jim Koontz says the telehandler’s adaptability and flexibility are what keep these machines in demand.

“We recognize that some of the most impressive percentage growth comes in the mini and maxi versions of telehandlers,” Koontz says. “The telehandler market in North America, and locally, continues to mature and incrementally grow. More and more trades see the benefit of this amazing tool. And the attachments that make it more versatile.”

Entering and expanding

New to this year’s list is Canada’s Cooper Equipment Rentals, which joined the T30 in 11th place, with an estimated 875 telehandlers in its fleet.

In 2022, Cooper invested CAD$175 million on fleet, and it expects that investment to continue, but with a flexible approach, says company CEO Doug Dougherty.

“When it was uncertain whether we could get equipment, we stocked up and said, lets buy,” Dougherty says. “Let’s keep it coming because we don’t know when it’s going to land, and we’ve landed a lot of equipment in the last two years. Now I think we can take a flexible approach to CapEx planning and say, OK, if we see the opportunity let’s write the cheque because we know we can get the equipment.

“We recognize that some of the most impressive percentage growth comes in the mini and maxi versions of telehandlers. The rotators also have a greater presence. Currently those markets do not interest us as they do not suit our needs,” Dougherty says.

About the Telehandler20 surveyResearch for the Telehandler30 was carried out during the spring of 2024. Where companies were unwilling to provide figures, we made our own estimates based on data from annual reports and advice from industry contacts. Thank you to everyone who contributed. If you would like to be included in next year’s list or would like to get a head start on our upcoming Aerials20 list, please contact ALH Editor Lindsey Anderson by emailing [email protected]. Please include the size of your current aerial or telehandler fleet, last year’s number and your company’s website address. |

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM