MEWP rental in the Middle East

15 September 2022

The Middle East is seeing a property upsurge and is diverging into new areas of technology but there are still challenges, including in the less mature rental markets in the region.

An increasing number of urbanisation projects will drive growth in the construction sector in the Middle East, according to information released by GlobalData.

ARG at work on a facility management project in Dubai. (Photo: ARG)

ARG at work on a facility management project in Dubai. (Photo: ARG)

While the Covid-19 pandemic has slowed down project spending in the region, the ongoing modernisation of populous regional centres such as Dubai and Riyadh since the oil price crash of 2014–15 will drive demand for construction.

Neha Bhatia, construction and infrastructure editor at GlobalData’s MEED, said, “Residential projects are driving post-pandemic real estate activity in Dubai. Select Group has awarded China State Construction Engineering Corporation Middle East an AED629m (US$171.2m) contract for its Peninsula One tower. Nakheel also recently selected local contractor ASGC to deliver its 418-unit Murooj al-Furjan project.

“Additionally, Saudi Arabian developer, Roshn, has received bids to deliver the first phase of the huge Al-Arous housing project in Jeddah, part of the Kingdom’s program of Vision 2030 megaprojects.”

Challenges facing the access rental sector

One of the major access rental companies in the region is a division of UK-based AFI Group, Access Rental Gulf (ARG).

ARG was established in 2008 in two locations – Jubail in Saudi Arabia and Dubai in the UAE. Following a recent programme of investment and expansion, ARG also established a presence in Bahrain, Qatar and a second depot in Saudi Arabia.

The new Qatar base was set up to enable ARG to capitalise on the increased construction spend in Qatar as the State increased its infrastructure in advance of the 2022 World Cup.

As Nick Selley, group business development director at AFI, says, the biggest challenges across the region remain cash collection, rental rates and the contraction in contract awards across the GCC in the short term.

The opportunities remain strong in the oil and gas sector across the region, “We also see strong growth in infrastructure projects as economies recover from 2020.”

And Selley is seeing some other notable trends. These include an increasing demand in equipment that is less than five years old and an improvement in the condition of machines and tyres, and there are increasing requirements for lightweight machines, including spiders.

ARG on a Dubai warehouse project. (Photo: ARG)

ARG on a Dubai warehouse project. (Photo: ARG)

As a result, says Selley, across the region, “the percentage of second-hand equipment should reduce but this will be subject to rental rates that the equipment commands.”

From a purely safety aspect, secondary guarding is now becoming more prevalent and is being stipulated for certain jobs.

However, the market does have its challenges. Korea Rental Corporation used to be present across the Middle East but has pulled out of all of them except the Kingdom of Saudi Arabia (KSA), where it operates around 400 MEWPs, with half of those being boom lifts and the other half scissor lifts.

Competitive pricing and government rules

Jaeduk Kim, the company’s manager of overseas operations, says that when oil prices were pushed down the rental rates in KSA dropped and, now, while the situation has changed, there is still a great deal of price competition.

Kim adds, “And the rules of government change a lot and [without anyone knowing about it]. This means if a rule is set, nobody knows enough about it, and it takes many steps to understand the detail of the new rule.

“Due to this, local players with special accessibility to governmental bodies have a competitive advantage over international players.”

The hike in new equipment prices brought about by the long delivery times, as a result of the current supply chain crisis, means there is less new equipment in the region, even if there is an increased preference for younger units in rental companies’ fleets. Therefore, there is more demand on used equipment.

However, there is also plenty of opportunity in KSA, following the implementation of its Vision 2030 plan which is designed to reduce the state’s reliance on oil, and includes a range of infrastructure plans across public services, recreation and tourism.

Another outcome of this is that the country is heading towards greener solutions and is planning on carbon zero cities and hydrogen plants in the coming years.

As a result, Kim believes there will be around a 15% growth rate per annum for access equipment over the next five years.

The growth potential is hardly helped by a lack of government safety regulations in the country. Nevertheless, says Kim, major companies like state oil provider Aramco have their own rules to provide safety. For example, in recent weeks, Aramco has accepted IPAF’s ePAL as a recognised qualification onsite.

At work in the KSA. (Photo: Korea Rental Corp)

At work in the KSA. (Photo: Korea Rental Corp)

Young rental markets

Of course, the more developed access markets of UAE and KSA do not represent the Middle East as a whole, and there is an abundance of younger access markets in the region.

MRT Makina, Turkey’s largest access equipment rental company, has been in Kuwait for more than three years and provides up to 400 platforms in the country, notably at a major new project, the Limak Kuwait International Airport new terminal build.

Aysema Arslan, rental coordinator at MRT Makina, says one of the greatest challenges in this region are the climatic conditions. “There are changes you need to make in your machines according to the climatic temperatures of the country where you will work.”

The frequency of maintenance may increase and the spare parts used must be suitable for the climate, all of which mean additional costs.

This is particularly the case in the summer months, with the high temperatures preventing machines and personnel from working during the day. And with work being caried out at night, it holds difficulties of its own.

In addition, says Arslan, the underdevelopment of wider industry means that the necessary technical services and spare parts are insufficient to meet the needs that a rental sector requires.

“You may have to wait for a long time from local suppliers for the delivery of the parts you need. Not being able to reach spare parts and technical service creates a serious obstacle to the uninterrupted operation of your machines.”

The company sends its spare parts directly from its home country Turkey to ensure uninterrupted service and delivery of parts.

Arslan adds, “To overcome the difficulties in the region, your company must be strong, have the necessary experience and human resources.”

Looking across Kuwait and other developing Middle Eastern access markets, unlike the likes of the UAE and KSA, which are already established, the idea of a fully structured modern urban environment is yet to fully develop, says Arslan, such as the building of apartment blocks, shopping malls airports, hospitals and sports complexes that complement each other.

“The increase in these projects will increase the use of machinery in the region and ensure the growth of the market.”

Feature article continues after box story below...

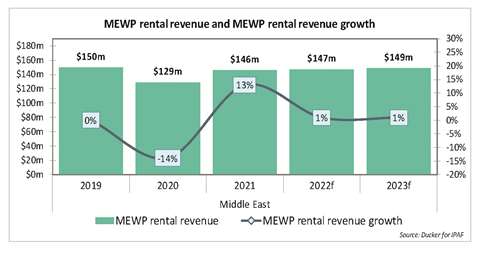

IPAF ReportsAs in 2021, IPAF’s 2022 Global Powered Access Rental Market Report contains a special focus on the Middle East Gulf Co-operation Council (GCC) countries of Saudi Arabia, UAE and Qatar. The picture is largely positive in the Middle East, says the report, with the recovery largely tracking the higher end of the European or the US market in 2021. On average across the three countries under study revenue grew by 13%, compared with 13% for France, 15% for the US and 7%, the European average.  IPAF Powered Access Rental Market Report 2022 - MEWP rental market value and growth. IPAF Powered Access Rental Market Report 2022 - MEWP rental market value and growth.

This recovery came largely as a result of improved average utilisation and rental rates, driven by the resumption of paused construction projects and new sources of revenue in facilities management. Total MEWP rental revenue recovered from the lows of the pandemic in all three countries under study, with combined annual revenue reaching $146 million, driven by ongoing infrastructure investment in the region and business generated by the Dubai Expo trade fair in the fourth quarter of the year. |

Why Turkey is key to developing the wider MEWP market

A more developed export market will also allow the access sector to flourish through the effective sale of used equipment to countries like Kuwait from Turkey, which will also help to reduce the average age of Turkey-based fleets.

New projects using MEWPs in the region will also encourage developments in specific safety standards.

Osman Gürbüz, deputy rental manager at another major Turkish rental company Fatih Vinç, which also works in Bulgaria and Azebaijan, says the global challenges, such as the supply chain, are affecting all countries in a similar way.

With Turkey being an important gateway to the the Middle East the strength of its own MEWP market is key to the success in wider markets.

“As a result of the worldwide economic fluctuations, Turkey has been affected as well as every country, and thanks to the wide service network we have in the country, we have minimised these negative effects and difficulties.”

Gürbüz also points to the importance of developing industrialisation in countries such as Azebaijan, as has occured in recent years in Turkey.

“MEWPs are needed more and more every day to work in faster and more reliable environments.”

Equipment increase

Gürbüz adds. “We think that with the implementation of Rules for Workplace Safety, in Turkey, the growth will increase and the area we serve will expand even more.

“For this reason, we would like to emphasise that growth will occur in the next five years.

“The increase in the number of units we use with each passing year shows that the percentage of need for this equipment type is also increasing.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM