Read this article in Français Deutsch Italiano Português Español

T30: Telehandler rental fleets are growing at the slowest rate since the pandemic. Why?

13 June 2025

A new report by Access, Lift & Handlers shows that rental firms’ investment in telehandler fleets is slowing in North America. Lindsey Anderson finds out why.

Photo: Magni

Photo: Magni

Investments in telehandler fleets among North American rental firms slowed dramatically in 2025 as economic uncertainty, high interest rates, supply chain disruptions and a slowdown in non-residential construction slowed demand.

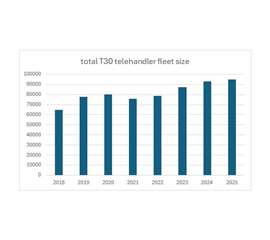

According to Rental Briefing’s sister title Access, Lift & Handlers, the thirty biggest telehandler rental fleets in the region comprised 94,710 units, a modest 2.65 percent increase over last year’s 92,893 total.

The Telehandler30 index, which calculates the number of telehandlers owned by rental firms in the region, closely tracks confidence in construction and rental markets and marks the smallest increase since 2021.

Telehandler rental fleets are growing at the slowest rate since the pandemic

Telehandler rental fleets are growing at the slowest rate since the pandemic

The index also echoes predictions from the American Rental Association (ARA) which is forecasting 5.2% growth for the U.S. construction this year, down from 8% in 2024. Looking ahead, growth is projected to further ease to 4.1% in 2026 and 4% in 2027.

“Economic uncertainty and relatively high financing costs, weigh on the outlook for investment,” said Scott Hazelton, managing director at S&P Global, the international forecasting firm that compiles data and analysis for the ARA forecast. “However, this is little risk of a serious downturn, and equipment rental can gain penetration in uncertain times.”

United Rentals remained the owner of by far the largest telehandler fleet in the region in 2025, comprising 35,500 units, an increase of 1.96% on the previous year. It was followed by Sunbelt Rentals which boasted a fleet of 28,000 units – a 3.7% increase on the previous year.

Herc Rentals came a clear third with a fleet of 9,800 telehanders. However, the company’s move to take over fourth placed H&E Equipment Services, which completed in June, is set to boost the company’s telehandler fleet size in next year’s table. The strategic move is poised to reshape the competitive landscape among the sector’s leading players.

And Herc is not the only major rental company looking to increase its fleet size and customer base through acquisitions.

For its fiscal full-year results, Sunbelt announced it completed 26 acquisitions totaling $845.6 million, including the purchase of Chicago-based RentalMax, Sunstate Equipment expanded across Arizona, California and Texas through buy-outs, and Canada’s Cooper Equipment Rentals added on Rent All Centre, Skyhigh Platforms and Big Stick Rentals.

We also saw some of the smaller players shift gears; Illini Hi Reach was acquired by RP Rents just one year ago. RP Rents since has bought out Time Savers and aerial/telehandler rental firm ALTA Equipment.

Yet, despite this rapid fire of consolidation across the industry, though, the Telehandler30 shows that firms have been keen to either diversify or sell off fleets, many of which are reaching the end of their “prime” rental age.

The top five:

| Rank 2025 | Company | Telehandler fleet size 2025 | Telehandler fleet size 2024 | Percentage change |

| 1 | United Rentals | 36,500 | 35,800 | 1.96% |

| 2 | Sunbelt Rentals | 28,000 | 27,000 | 3.70% |

| 3 | Herc Rentals Inc | 9,800 | 9,500 | 3.16% |

| 4 | H&E Equipment Services | 8,300 | 8,300 | 0.00% |

| 5 | Sunstate Equipment Co | 4,400 | 4,700 | -6.38% |

The full T30– with company rankings (and how those rankings have changed since the previous year), sales data and in-depth analysis – appears in the May–June issue of Access, Lift & Handlers, available to read for free here.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM