Read this article in 中文 Français Deutsch Italiano Português Español

Forecasting access in 2025 - what lies ahead for rental firms and OEMs?

03 December 2024

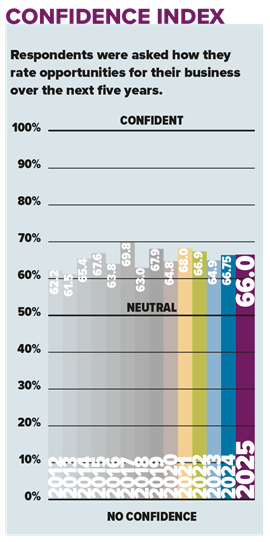

Access International’s annual Confidence Survey of manufacturers, rental companies and end users has revealed a steady outlook for the year ahead in terms of business performance, amid continued challenges and uncertainties in the sector and wider economies.

The survey’s Confidence Index, which records expectations for the next five years from all those that took part, is almost the same as last years figure at at 66. The Index in the December 2023 study the Index stood at 66.75.

2025 Confidence Index. (Image: KHL).

2025 Confidence Index. (Image: KHL).

This compares to the index’s highest level in very recent years of 68, recorded in 2021, as restrictions around the Covid-19 pandemic lifted, following a low of 64 in 2020 that had not been seen since the years following the credit crisis of 2008. In this respect, while confidence has dropped it remains higher than in previous periods of market instablity.

The five-year outlook reflects the rest of the graphs in the survey, which are based on forecasts for 2025 only.

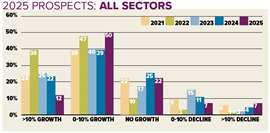

Looking at prospects across all sectors covering manufacturers, rental companies and end users for the year ahead, expectations are marginally down on last year. A majority of participants (50%) are forecasting growth of 0-10%, which is higher than last year. However, the percentage forecasting more than 10% growth has halved in the same period. There is also a smaller percentage forecasting declines in their business in 2025.

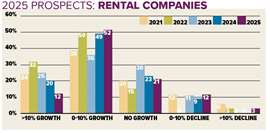

On the subject of rental companies specifically, the expectations of growth and declines are very similar to last year’s figures, although a higher percentage say they will make investments in new equipment compared to last year, (48% compared to 37% this time in 2023).

When it comes to investments in used equipment there is a notable rise on last year in those saying they will not invest (at 62% compared to 41% last year). On the other hand, the percentage planning to replace fleet is considerably lower than last year’s (at 19% compared to 30%).

Rental companies’ plans to replace new equipment has gone up just over 10% to 48%.

These results are somewhat reflected in the manufacturers’ feedback. OEMs and distributors are seeing an uptick overall in expected growth in the 0-10% margin next year and in terms of equipment sales the view is fairly similar overall, as are their production levels.

|

About the Access Confidence Survey See all the graphs in the Confidence Survey, published in the November/December 2025 issue of Access International. |

Mixed picture

While we have a similar level of confidence to last year in the tables, the comments provided by those taking part are less positive overall.

As always, it’s a mixed picture, often depending on individual circumstances. That said there are general trends, one of which is recent declines in Northern Europe compared to the south of the continent.

Prospects - all sectors. (Image: KHL).

Prospects - all sectors. (Image: KHL).

One participant based in Sweden and commenting about Scandinavia in general wrote: “2024 has been a terrible year, but we hope that everything terrible that happens in our world will end and thus change the market for all of us.”

Eastern Europe seems to be suffering from the same level of concern. From Slovakia, one respondent said, “In 2025, we expect the rental market to continue to decline. The year in 2024 was marked by a decrease in construction production by 7%. This is mainly reflected in a significant drop in prices.” Another participant from Hungary supports this trend, with the comment, “It is not growing”.

In Northeast England, times are equally uncertain, it appears. “This industry is very much feast or famine. It’s very cutthroat with no real alliance with anyone. Regarding machinery there are some impressive Chinese machines coming onto the market at some decent prices.”

Another participant has a different view, “Value of used equipment is damaged due to mass production from China.

“The influence of new manufacturers will change the dynamic of traditional purchases,” reports another commentator.

The Netherlands, on the other hand, is “stable” says one respondent.

Continental views

The situation is different in the south. Writing about Spain and Portugal specifically, one commentator stated: “The Iberia region will increase business moderately; around 5-6%.” And in Italy, “Rental is going very well,” says another, adding, “Sales are expected in this sector.”

Prospects - Rental companies. (Image: KHL).

Prospects - Rental companies. (Image: KHL).

That said, it’s not all plain sailing in the south says one manufacturer: “European markets are tough in certain areas such as Nordics and Germany. Many south European manufacturers are getting involved in pricing wars and sales directly from the factory past local importers,” adding, “The North American market and Asian market is generally moving forward quite strongly. Safety regulations and labour shortages increase demand for safe and efficient lifting solutions.”

The Asian markets referenced here are likely to be the emerging Southeast Asian markets and potentially the Middle East, which is seeing strong growth, particularly Saudi Arabia. Asia’s largest single market China is experiencing a significant downturn and fierce competition among rental companies and manufacturers.

On the subject of growing access markets generally, they have a common shared experience. In Brazil, a rental company said, “We expect the Chinese manufacturers to keep gaining market share over the USA and European manufacturers, and we hope the acquisition price starts to decrease.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM