Read this article in Français Deutsch Italiano Português Español

How to survive the China rental crisis

08 January 2025

For a small to medium-sized access rental company like China Construction Bright Future (CCBF), the stakes are high in a country that has seen its rental and construction market slashed due to toughening market conditions. How will it survive when a large percentage of its fellow renters are expected to shut down this year?

According to Wang Shijin, chairman of CCBF, the Chinese access market has risen at an astounding rate over the last decade to bring the overall number of aerial lifts in the country to nearly 700,000 units, not far off the world’s largest market of the US.

Wang Shijin, chairman of CCBF.

Wang Shijin, chairman of CCBF.

Such wild growth has left the rental sector facing severe challenges following the wider economic and construction industry downturn in the country, “leading to low utilization rates and rock bottom rental rates,” adds Wang.

The oversupply of access equipment from the numerous access OEMs based in the country has not helped matters. And that is combined with a swift move to all-electric rough terrain equipment following encouragement and regulation from the government, which has reduced the number of diesel-powered equipment able to work in the country.

Based on these dynamics, how do those smaller to medium-sized rental companies hope to survive, many with large numbers of diesel units in their fleets combined with a lack of finance to invest in new equipment?

CCBF, with its fleet of 1,700 MEWPs, is one such company. It is facing the challenges with a range of initiatives that it believes will not only lead to its survival but also make it a strong contender in the long term.

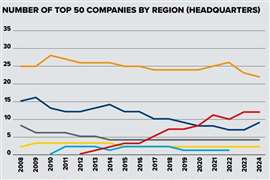

As Wang explains, smaller rental companies have a different set of challenges to remain relevant in a market where the big players like Horizon Construction Development have anywhere up to 180,000 MEWPs in their fleets. Horizon, as the second largest MEWP rental company in the world with massive investment capabilities, is setting up partnerships in a range of countries, including Southeast Asia to rival longstanding rental houses in those countries – something that a much smaller outfit such as CCBF could never achieve.”

See more about Horizon and the big Chinese access equipment rental companies in the Access50 Extended:

Taking the initiative

Now in its 12th year in operation, Shanghai-based CCBF was one of the first rental companies in China and as such has a history of innovation and adapting its approach to a changing environment.

Wang says, “Rental rates are very low and are below our costs. The problem is there are too many lifts that have been produced in our country and the prices have been pushed down. So, we have to diversify.”

The company’s latest initiative has seen it move into complementary areas of activity, including refurbishment and international trade.

Before the downturn in China, CCBF had already set up a distributor wing, presenting JLG and Dingli in China through its JieDing Industry (JDi) domestic sales division. JDi also has exclusive distributor rights for Italy’s Platform Basket and Aiman products.

CCBF distribution products on show.

CCBF distribution products on show.

However, in addition, the company has now become the biggest trader of used equipment (UE) in China under its Niars INT international trading wing and has delved into remanufacturing with UE division.

The latter two divisions have been set up partly in response to the toughening rental market and the need for companies to diversify and mature.

It hasn’t helped that the number of construction projects have also significantly reduced due to the failing economy. Adding to that dimension, access equipment in China has not yet progressed away from construction to applications that are not so affected by a cyclical economy, such as maintenance, utilities projects and energy supply. It means that the access sector has been hit almost as hard as the rest of the construction sector.

“We have tried to match the situation and reduce our prices, but we make no money, and profits have gone down,” says Wang.

One way of combating this is through the company’s UE remanufacturing which is focused on converting used diesel booms to electric units, then selling them on to other rental companies in China which may not be able to afford new green equipment.

“In China 90% of boom lifts are electric, so it stands to reason people want to change their diesel boom lifts to electric,” explains Wang.

Apart from focusing on other companies’ boom lifts, CCBF is also keen to move its diesel booms on either through conversion or sales outside the country.

As of September 2024, the company had sold 10 converted or remanufactured JLG and Dingli boom lift models in the 22m and 28m working height categories. This figure is set to multiply this year and beyond, adds Wang, “and we will do other brands in the future too.”

Where in the world?

With this comes the issue of where to send the diesel booms. While selling them on to other countries where the transition to electric is far less advanced, or in many cases has not yet begun, would seem like an obvious move, however contacts need to be established around the world.

Niars INT was set up last year to do just that.

CCBF’s rental yard in Shanghai.

CCBF’s rental yard in Shanghai.

In 2024 the division sold more than 100 units to countries outside of China, including brands such as JLG, Genie and Dingli. In addition to used diesel models the division sells new equipment internationally from Chinese manufacturers such as Zoomlion and XCMG, among others. Its main customer base so far is in the Middle East and Eastern Africa.

Wang is very confident about the potential of the international business and forecasts that Niars INT will sell 400 units abroad in 2025.

According to Wang, the division is finding customers by scouring the websites of potential buyers, as well as relevant Facebook and LinkedIn accounts, among other online sites.

There are other avenues to grow the international side of the company too. “Other distributors and trading companies in China buy from us and sell the equipment on to their customers. In addition, we have clients that introduce us to their contacts.”

As one might expect, CCBF’s plan is to grow its rental fleet of all-electric rough terrain units, while continuing to reduce the diesel offering - partly through its own refurbishment and trading channels.

Specifically, there will be a focus on reining back on boom lifts between 24m-26m working height. Wang explains, “Many companies are focusing in that field so there is a lot of competition.”

Those units will be replaced by 50m and above boom lifts, where there is a niche, yet growing market.

Large scale investment

CCBF’s latest acquisition in this arena is one of Zoomlion’s ZT72J-V boom lifts, which apart from offering a 72.3m working height has a horizontal outreach up to 32m. There are only a handful of units currently in operation, says Wang, and CCBF has one of them. This joins nine other large booms in the company’s fleet above 50m, and by the end of this year there will be another 10 added to the portfolio. Again, they are likely to be from Chinese brands such as XCMG and Zoomlion, says Wang.

Zoomlion’s even larger 82.3m maximum working height telescopic boom, pictured at Bauma China 2024. (Photo: KHL)

Zoomlion’s even larger 82.3m maximum working height telescopic boom, pictured at Bauma China 2024. (Photo: KHL)

These larger booms are finding work in maintenance of aging buildings, along with theme parks, railway stations and government buildings. Wang adds, “The fact is they are easier to rent as there are applications for them outside of construction and in areas like maintenance where there will always be work.

“Rental rates are also higher for this type of work, as not so many rental companies have them and there is less competition.”

It will mean that like other rental companies in China, CCBF will reduce its fleet size over time. However, in CCBF’s case it won’t be the result of a failing business, rather the company’s focus on replacing its significant number of standard sized RT booms with fewer super booms.

According to Wang, of the 2,300 rental companies currently operating across the country, some 30% of them will no longer be in operation by the end of this year. OEMs, he predicts, will see a similar decline in numbers of 30%-33%.

CCBF’s utilization rate stands at around 70%, compared to the current average of 60%-65%. This amounts to a 10% reduction from a year ago.

One reason for this is the company’s aforementioned move into big booms that are out on rent, rather than sitting in the yard, and the sale of its underutilized stock to other companies at home and abroad.

Maximising potential

While remanufacturing and used export sales are hardly new concepts, CCBF believes they show how it is one step ahead of the competition, particularly in a country that is just starting out on the road to rental maturity.

Wang also argues that as a small company CCBF is able to be more nimble than large rental companies and is better placed to offer unique, customized services, even on a global scale.

Without diversifying in the way CCBF has, Wang believes there are few opportunities for small rental companies to grow in the current climate, beyond cutting costs through demanding lower purchasing prices from the OEMs or agreeing to longer payment plans reaching up to years – both of which cause pressures of their own for the wider industry.

Another avenue for the rental sector as a whole will be to force up rental rates over time, which Wang says will be a necessity if the sector is to operate effectively in the long term and reach a satisfactory level of maturity.

The reality is, the tough economic conditions will continue to the end of 2025, Wang adds. “The big rental companies will not increase their fleets by much and the middle-sized and smaller rental ones are reducing their fleets.”

To combat the decline CCBF will continue to expand into new areas and look beyond the borders of China. “We will open branches in other countries like east and southern Africa and take our opportunities where we can.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM