Read this article in French German Italian Portuguese Spanish

Off-Highway Research publishes indepth China access report

15 September 2025

The market for powered access platforms in China saw phenomenal growth over the last decade, increasing from about 8,600 new machines sold in 2014 to 138,900 in 2024, according to specialist consultant Off-Highway Research.

The concept of aerial platforms was first introduced to China in the early 1990s, but their use was largely limited to shipbuilding, and large non-residential building projects such as sports stadiums and hotels.

Image: Off-Highway Research.

Image: Off-Highway Research.

However, changes to working and safety practices, the emergence of a rental industry in China, and the fact that many manufacturers leapt into the market as it took off in the 2010s meant that sales went on to exceed the industry’s wildest expectations.

As with sales of many other equipment types, the market began to cool in the early 2020s following a brief but spectacular period of stimulus spending at the start of the Covid pandemic. Platform sales held on a little longer than earth moving equipment, but growth began to slow down in 2022 and the market went on to turn with an abrupt decline of 21% in 2024, thus ending the first boom of the Chinese access platform industry.

This was triggered by China’s economic slowdown, which has impacted the sector across construction and industrial segments, while the collapse of the Chinese real estate segment has been particularly damaging to demand related to construction activity.

|

Available in Chinese This article is available in Chinese. Click here for analysis of the MEWP market in China, including its challenges and opportunities, with links to the full 130-page report and how to purchase it. |

Scissor lifts are still the most popular type of access platform in the market, but their share of the overall market has fallen significantly from the mid-2010s, when they represented almost 90% platform sales. This is due to the saturation of the market in this product group particularly, which was driven to some extent by the huge influx of new manufacturers and rental companies into the segment in the boom years.

In light of this, the market has swung much more towards telescopic boom lifts, both in absolute terms and as a proportion of sales of all platform types, while articulated boom lifts are yet to achieve genuine acceptance in China.

Platform population

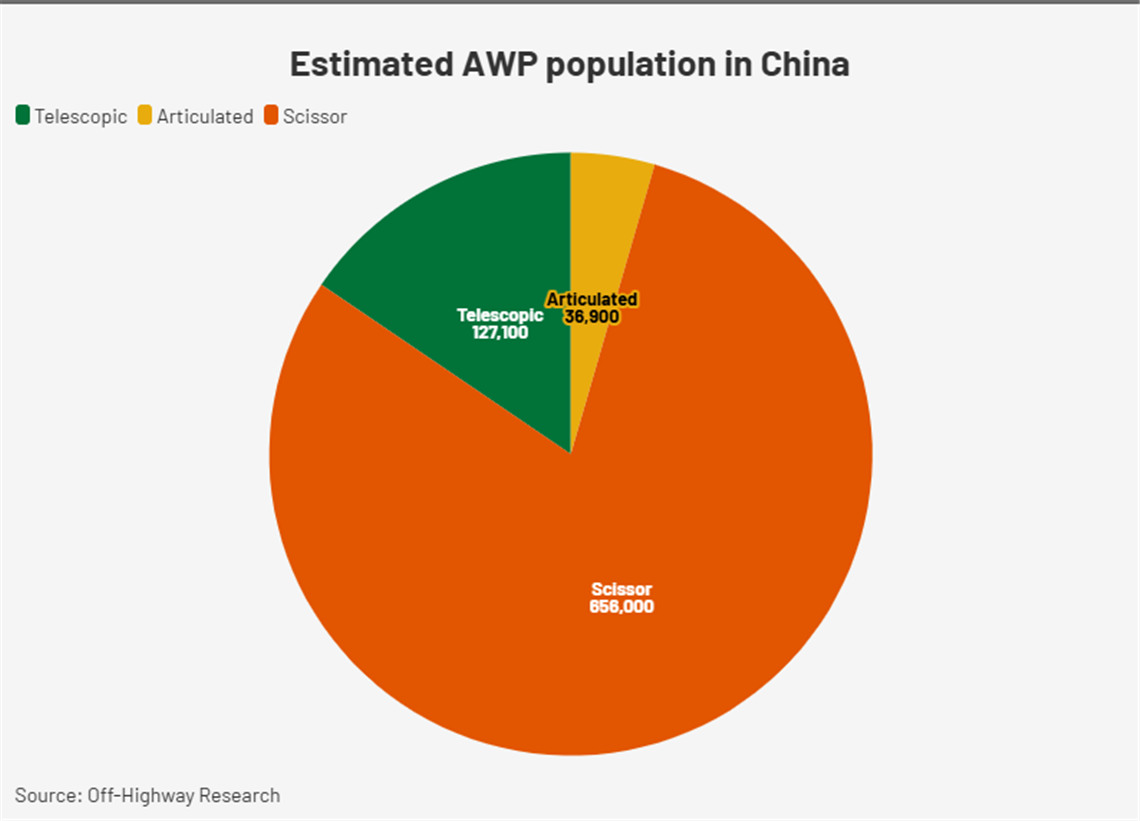

The problems in the Chinese economy which slowed platform sales over the last two years or so came at a time when the population of equipment was arguably saturated. The AWP population in China is believed to have increased from 100,000 units in 2018 to over 820,000 units this year. Put simply, too many machines are now competing for a limited volume of work and rental rates have fallen sharply as a result.

|

The Powered Access Industry in China Off-Highway Research’s new 130-page report is believed to be the most detailed and in-depth study ever produced on the Chinese powered access segment. Coverage includes:

It also includes profiles of more than a dozen major AWP rental companies in China, including the big three fleet owners. Available in both English and Chinese, the study is essential reading for any stakeholders involved in the Chinese AWP sector, from component suppliers and OEMs to rental companies and fleet owners. It is designed to help senior managers make strategic decisions and plan for profitable growth. For more information contact [email protected] or buy online at www.offhighway-store.com |

What’s more, rapid growth in sales in the early 2020s, mean the fleet is also young with almost 90% of the platforms in China being five years old or less. That’s good news for end users, who can now rent young machines cheaper than ever, but it is hugely problematic for manufacturers wondering where the next sale is going to come from.

Again, this particularly applies to scissor lifts, which account for some 80% of the population., but there may be opportunities in boom lifts. Telescopic machines dominate the boom market at the moment, and have certainly been the growth area of the last few years. There is not yet widespread acceptance of articulating booms in China – a sign that the market is still somewhat immature – and while this might be an opportunity, it would be a brave manufacturer or rental company to put a bet on at this point in the market cycle.

It is believed that the platform population is spread across an estimated 3,000+ specialty rental companies in China. Although in some niche applications machines are owned by end-users, rental companies are believed to hold at least 95 per cent of the total machine population.

Most of them operate in the more industrialised and well-developed eastern provinces, although there have been increasing volumes of machines sold to new rental outlets in other expanding regions. It is also common for the central and western regions to act as disposal routes for used platforms which have had their first lives in the Eastern provinces.

It is understood that over 60 per cent of the fleet population is owned by the three leading companies, namely Shanghai Horizon Construction Development (HCD), Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology (Huatie), and Zhongneng United Digital Technology (Zhongneng United).

Market outlook

Having boomed in the early 2020s, it is clear that the powered access market is undergoing a correction at the moment. Off-Highway Research’s forecast is for the market to bottom-out in 2026 and 2027 at about 75,000 units sold per year. That total would be just 55% of the volume seen in the peak year of 2024. A painful adjustment.

As grim as the overall market dynamics look, there will be opportunities in the coming years. As already mentioned, the boom lift market shows potential to grow and mature. The fact that rental companies and manufacturers alike are under pressure will force them to try to find new applications for access platforms – again, as previously mentioned, the market in China is construction-centric at the moment, so there is potential to grow into new end markets.

Electrification is another opportunity. Although roughly 95% of the machines sold are already electric, there is an opportunity to push that figure towards 100%, with a focus on big booms and rough terrain platforms. China has a huge strategic focus on electrification, and the drivers of this trend are not to be underestimated. In the earthmoving equipment segment, 80% of electric machines sold worldwide last year were in China (and a further 10% by Chinese OEMs in export markets). This indicates acceptance and trust of the technology in the marketplace.

Finally, exports will be vital for the platform manufacturing industry in China in light of the enormous production capacities which have been built up and the increasingly competitive nature of the domestic market. The headwind to exports is of course the backdrop of international trade friction and rising tariffs. These are encouraging Chinese OEMs to build factories abroad but it will still take time for them to capitalise on their investments, and gain positions of strength in overseas markets.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM